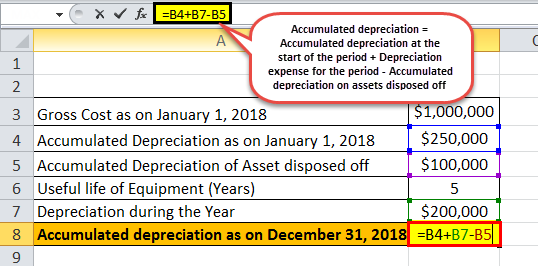

Accumulated depreciation formula in excel

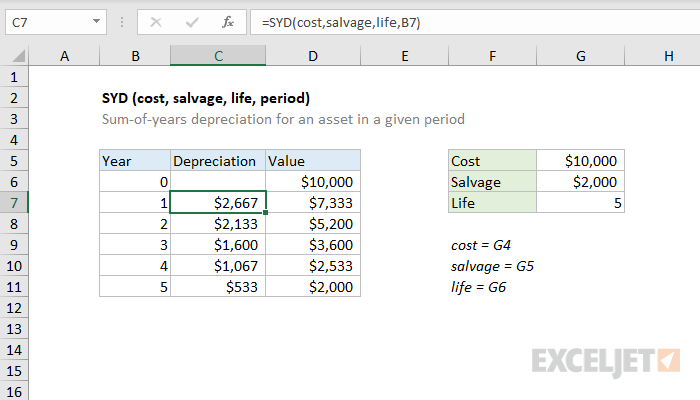

The final method for calculating accumulated depreciation is the SYD or sum of the years digits. How to prepare Assets schedule in Microsoft ExcelThis video helps you to understand that how to make a spread sheet of Depreciation accumulated depreciati.

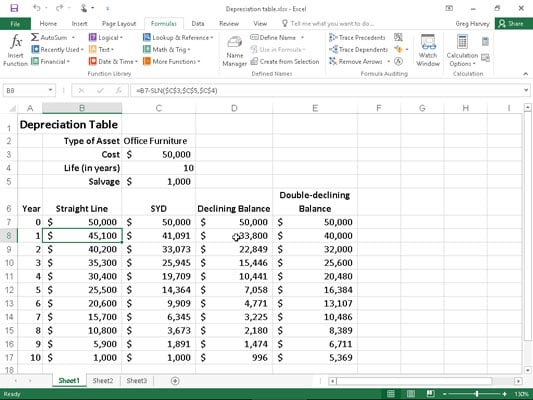

Depreciation Schedule Formula And Calculator Excel Template

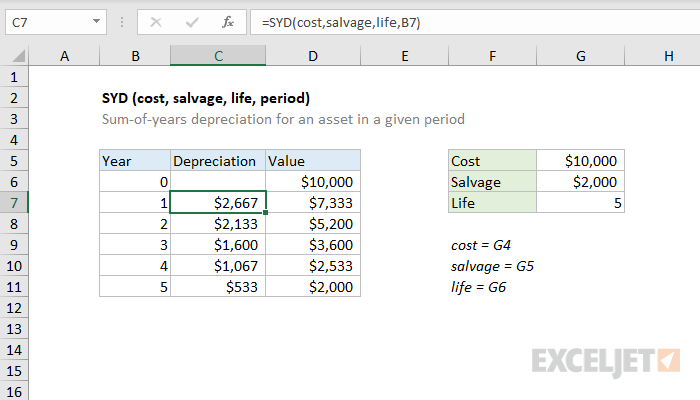

Excels Syd function calculates the depreciation of an asset over a specified period using the sum-of-years digits method.

. You can also create a depreciation schedule using the Sum of Years DigitThere is an in-built Excel financial function to calculate depreciation using this. This function uses the following equation. Calculate Accumulated Depreciation by Given Information Cost of the Machinery.

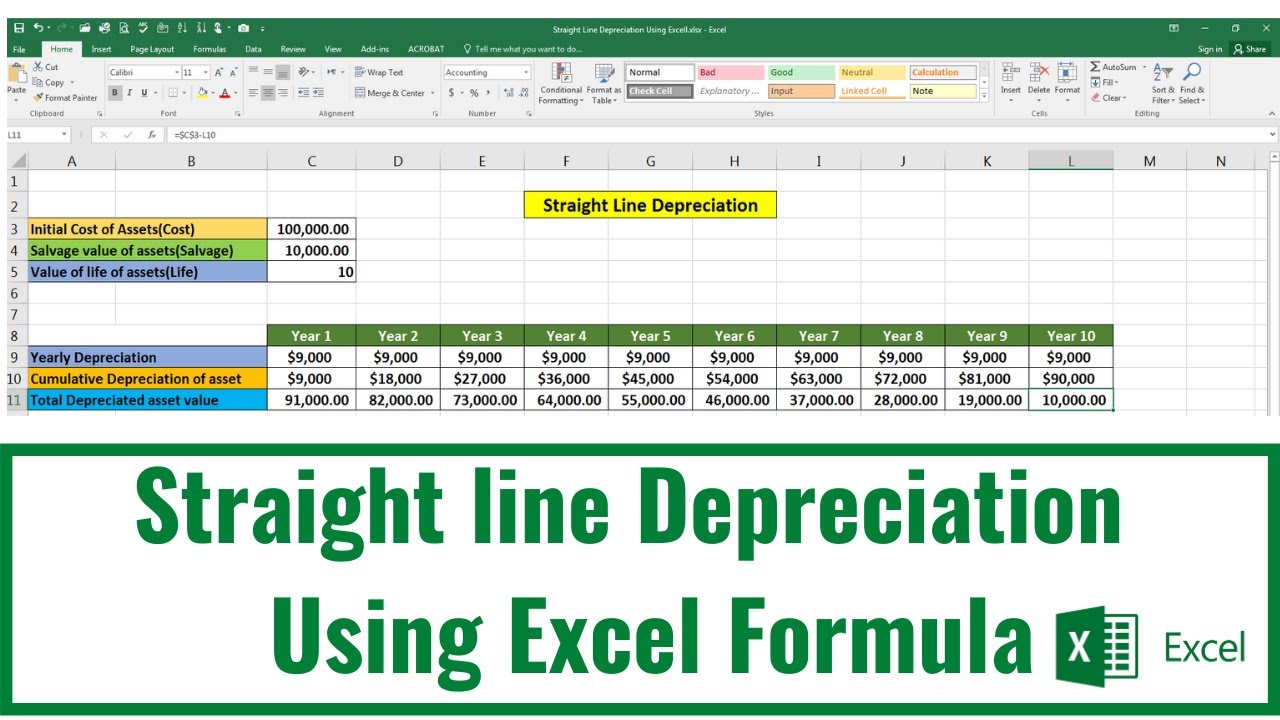

This formula looks like this. Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years. Where cost initial.

Accumulated Depreciation Excel Template Visit. Dear Team I am experimenting to automate the tedious process of manually calculating the Accumulated depreciation Balance. This formula is not working I want to calculate Accumulated depreciation in this way if E2 is lesser than D4 no depreciation if E2 is greater than D4 then calculate.

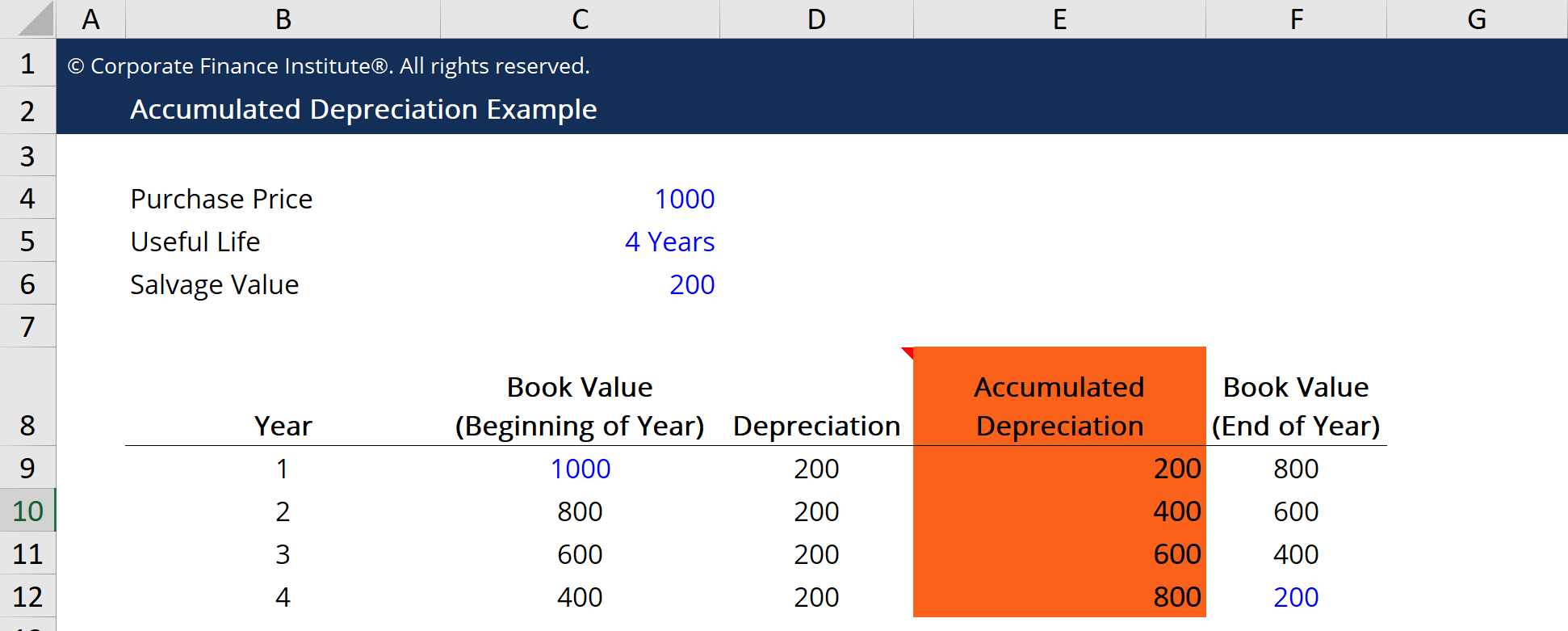

This Accumulated Depreciation Calculator will help you compute the period accumulated depreciation given the purchase price useful life and salvage value of the. The calculated depreciation is based on initial asset cost salvage. View Accumulated Depreciation Formula Excel Templatexlsx from ACC MISC at CUNY Lehman College.

Sum of the years digits SYD method. The Depreciation Schedule is used to track the accumulated loss and remaining value of a fixed asset based on its useful life assumption. To calculate the depreciation using the sum of the years digits SYD method Excel calculates a fraction by which the fixed asset should be depreciated using.

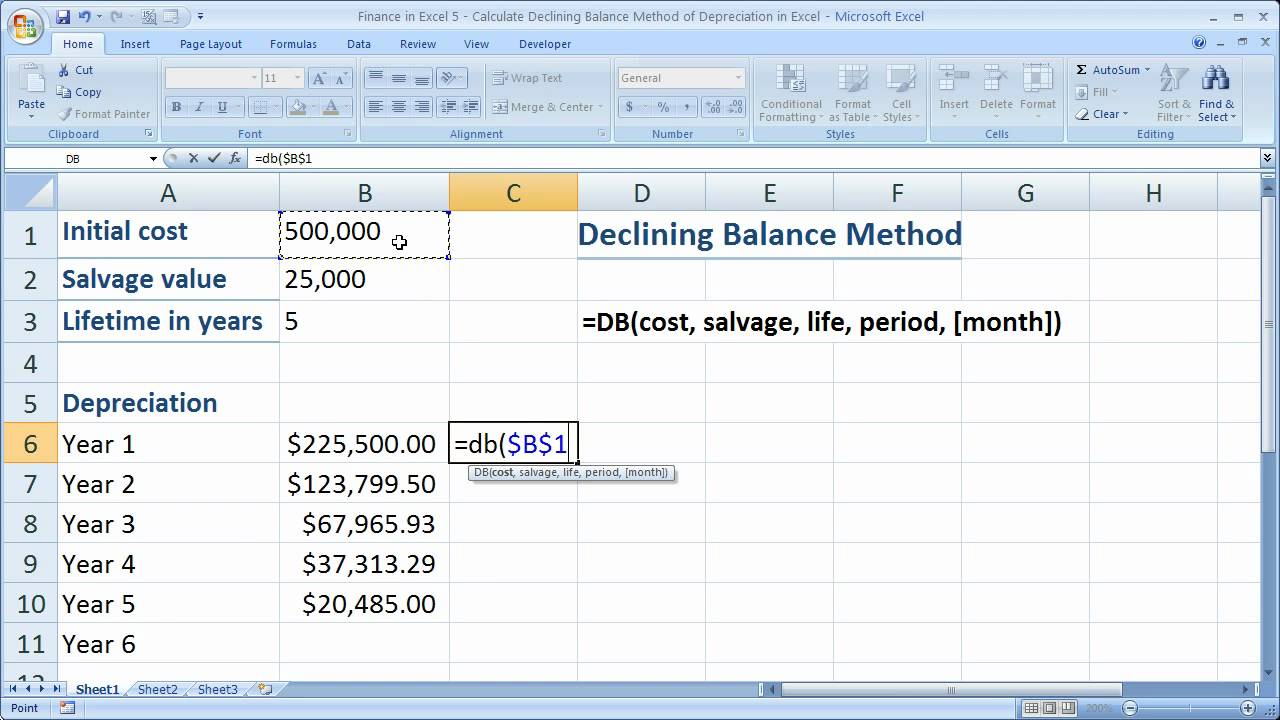

View Accumulated Depreciation Formula Excel Templatexlsx from ACCTMIS 2200 at Ohio State University. The Excel DB function returns the depreciation of an asset for a specified period using the fixed-declining balance method. Depreciation is a non-cash expense that reduces the.

Sum of Years Digit. Complex Depreciation Formula WDV SLM.

Practical Of Straight Line Depreciation In Excel 2020 Youtube

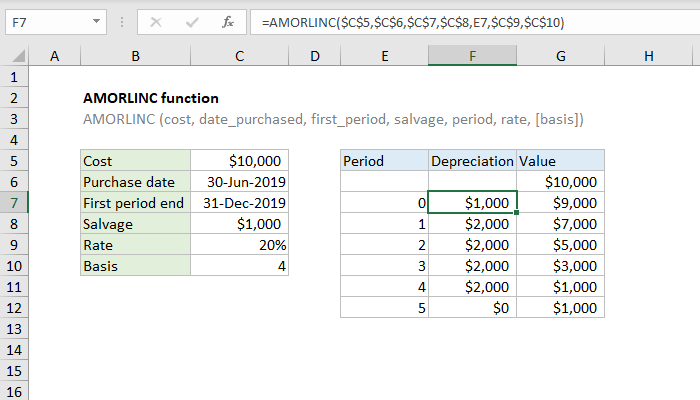

How To Use The Excel Amorlinc Function Exceljet

How Can I Make A Depreciation Schedule In Excel

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Calculator

An Excel Approach To Calculate Depreciation Fm

Depreciation Formula Examples With Excel Template

Using Spreadsheets For Finance How To Calculate Depreciation

Accumulated Depreciation Definition Formula Calculation

How To Use The Excel Db Function Exceljet

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Accumulated Depreciation Definition Formula Calculation

How Can I Make A Depreciation Schedule In Excel

How To Use The Excel Syd Function Exceljet

How To Use Depreciation Functions In Excel 2016 Dummies

Calculating Depreciation Using The Sln Function Extra Credit

Accumulated Depreciation Definition Formula Calculation